Sep 11, 2023

Introduction

For ship owners, ship operators and traders, managing financial processes such as month close and accruals can be intricate and time-consuming.

Revenues and expenses need to be recognised and accounted in a timely manner, to accurately reflect the financial position at a given time.

Accrual management is crucial for this – as it is fundamental to reflect the financial position accurately. Companies need to account for revenues and expenses that occur during a voyage but are not yet invoiced or recorded.

With good accrual management, accurate financial reports can be easily generated. Without these, owners and operators struggle to gauge the profitability of their activities.

Manual Systems Used Currently

Traditionally, owners and operators have created complicated Excel spreadsheets, and manually updated them. These spreadsheets typically contain all entries for expenses and revenues, and are split up by voyage or by vessel.

Once results are finalised in the Excel, they are then manually re-entered into the accounting system, such as QuickBooks, Sage, Dynamics or SAP

The Problem

This system can work – but comes with serious drawbacks.

These manual methods require huge amounts of manual updating and intense team coordination to maintain.

Teams are doubling up their work by maintaining two sets of accounts: one in Excel and a second in their accounting system. This double-work can potentially waste 10 to 20 hours a month.

Moreover, if you need to make a change in the Excel, you’ll also need to manually update your accounting system. Everything has to be done twice.

Closing a period can also present a serious challenge to finance teams, as it requires them to go through accruals one by one and pass them through complex rules to finalise and close the activities for the previous period. Prior period adjustments all have to be created and updated manually.

This kind of manual system is not just time-intensive, it’s also risky. It relies heavily on the small number of team members who created or regularly use the spreadsheets. New team members can have a hard time learning how these complex spreadsheets work. Most importantly, this high volume of manual tasks leads to a high risk of errors.

How a VMS Helps

Implementing a Voyage Management System (VMS) can significantly streamline these financial tasks, and reduce the overall risks involved.

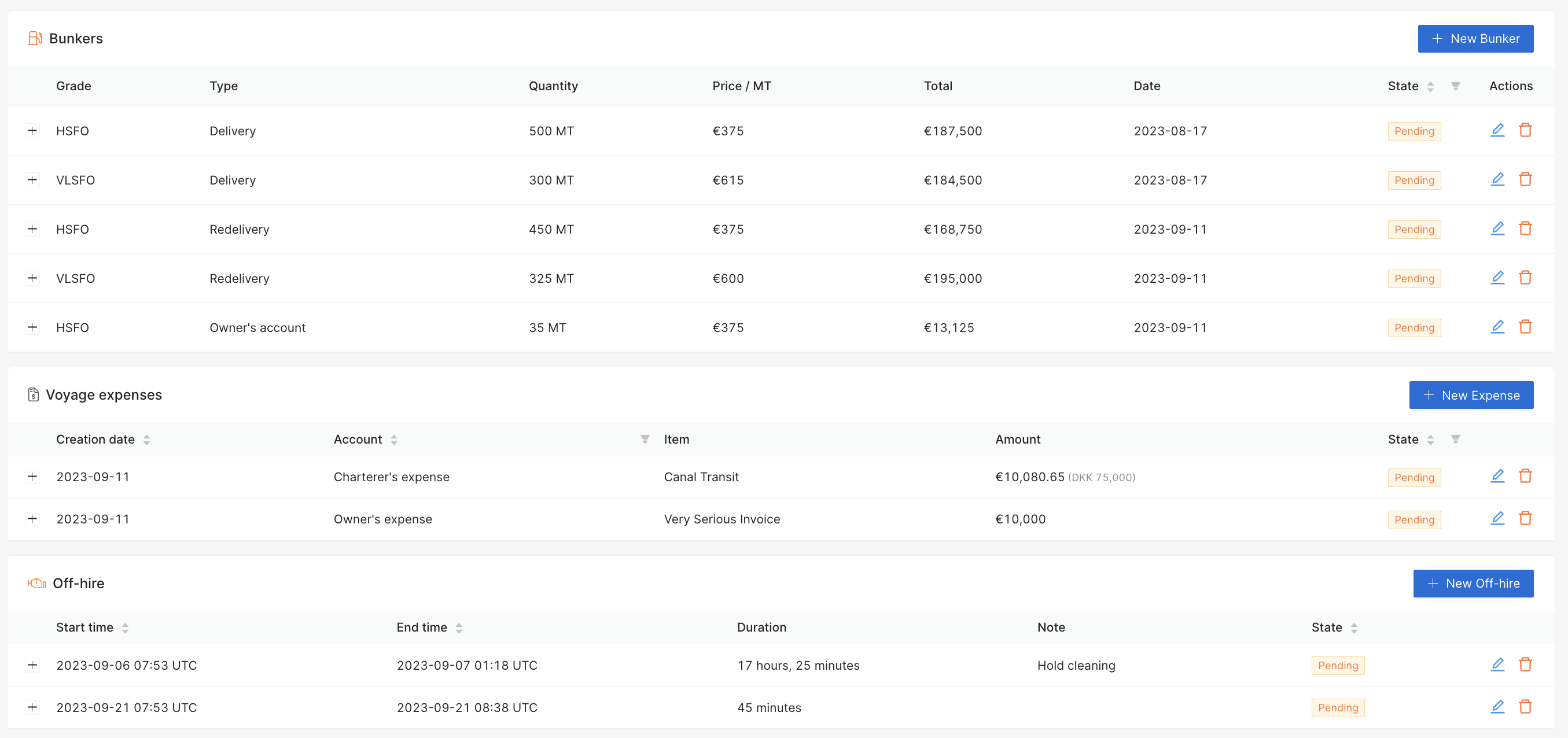

It does this by eliminating the need for manually entering and maintaining all voyage transactions in Excel spreadsheets. Instead, team members can plan and execute all tasks for a voyage on one platform, and as they work, the VMS automatically creates the accruals in the accounting system via an integration.

So, whenever a task generates an expense or revenue, the VMS can create a corresponding accrual in your accounting system.

For example, you might be entering the “delivery date” and “bunkers on delivery” into the VMS in order to generate the first hire invoice. The VMS will generate the necessary accruals in the accounting system for you at the same time.

There’s no need for any Excels or double work in this new setup. Furthermore, any changes made within the VMS will be applied automatically to the entries in the accounting system – further removing any need for double work

Generating a period close can also be greatly streamlined with a VMS, as it will handle the processing of each accrual, and can automate tasks such as creating reversals at the start of a new reporting period

Defining the Benefits

10-20 Hours of Time Saved

A VMS can eliminate the need for running two disconnected systems and greatly reduce the amount of time spent on manual repetitive tasks by up to 20 hours per month. Any reduction in manual tasks has the added benefit of reducing the risk of errors.

More Clarity

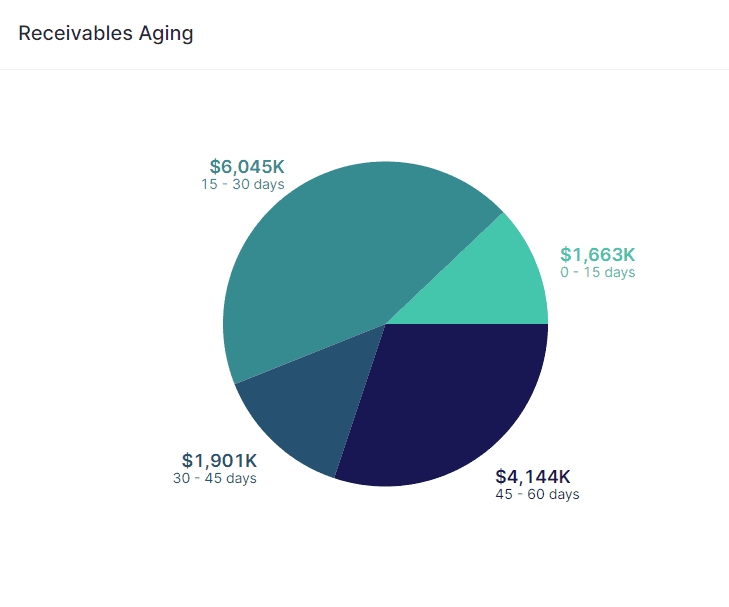

With a VMS in place, finance teams can access real-time data. By providing a consolidated view of all financial information, a VMS empowers shipping companies to make informed decisions based on accurate P&L data.

Collaboration & Controls

Efficient collaboration and communication among stakeholders are essential during month close and accrual processes. A Voyage Management Software offers a collaborative platform that allows all team members to work on the process at the same time – with complete transparency.

Furthermore, a VMS can support custom approval and review processes, providing robust controls and general good practice, which simply is not possible in an Excel-based solution

This also eliminates bottlenecks and reduces delays in month close procedures.

Compliance

Compliance with accounting standards and regulations is critical in the maritime industry. IFRS dictates the way in which revenues can be accounted for, and a VMS can provide the certainty you need to adhere to industry-specific financial reporting requirements and regulatory standards. By implementing built-in

controls and validation checks, a VMS helps maintain data integrity, accuracy, and consistency in voyage financial management.

Simpler Audits

In addition, a VMS simplifies the audit process by providing a comprehensive storage system for financial data, reports, and supporting documents. Auditors can easily access the necessary information within the VMS, expediting audit procedures and reducing associated costs.

Conclusion

Perhaps you see benefits for your company here, and are considering implementing a Voyage Management System? If you’d like to know more – please take a look around

Or you can book a free demo below