Oct 16, 2024

Time Charter Equivalent, or TCE, is one of the most critical financial metrics in the shipping industry. It is used to measure the daily income of a vessel by standardizing the earnings from different types of charter agreements, most notably voyage charters and time charters. The TCE helps shipowners and operators evaluate the profitability of their voyages by translating their earnings into a comparable figure.

In this blog, we’ll dive deep into the concept of TCE, how it’s calculated, why it’s important, and how you can use it to better manage your shipping operations. We’ll also explore the tools, like a TCE calculator and time charter equivalent Excel templates, that make these calculations easier to handle.

What Is Time Charter Equivalent (TCE)?

Time Charter Equivalent (TCE) is essentially a performance measure that helps shipowners and operators understand how profitable a voyage or charter is when normalized on a per-day basis. It converts the income from various chartering methods into a standard daily rate, making it easier to compare performance across different voyages and charter types.

For instance, if a shipowner engages in both voyage charters and time charters, their earnings can vary significantly depending on fuel costs, port fees, and other factors. The TCE allows them to calculate the daily income from both types of agreements in a uniform way, offering a clear picture of how well their vessel or fleet is performing financially.

Why Is Time Charter Equivalent (TCE) Important?

TCE is one of the most widely used metrics in the shipping industry because it provides a reliable way to measure and compare vessel earnings. Shipping is a capital-intensive industry where even minor fluctuations in rates, costs, and operational efficiency can lead to significant changes in profitability.

TCE is important for several reasons:

Performance Evaluation: TCE allows shipowners to compare the financial performance of their vessels. For example, a tanker operating on a voyage charter in one route can be compared to a vessel on a time charter, despite the differences in the contractual terms.

Operational Decision-Making: Knowing the TCE for various routes and cargo types allows operators to make better decisions about how to deploy their fleet. They can opt for routes and chartering types that maximize profits.

Financial Reporting: Many shipping companies use TCE in their financial reports to provide a transparent and comparable measure of profitability. It is a key indicator for stakeholders to assess the company’s performance.

Time Charter Equivalent Calculation Example

The basic formula for calculating TCE is:

TCE=(Voyage Revenue−Voyage ExpensesVoyage Days)TCE=(Voyage DaysVoyage Revenue−Voyage Expenses)

Here’s a breakdown of the terms:

Voyage Revenue: Total earnings from the voyage, including freight and other income.

Voyage Expenses: Costs incurred during the voyage, such as fuel (bunker) costs, port fees, and canal fees.

Voyage Days: The total number of days from the commencement of the voyage to its completion, including any waiting time.

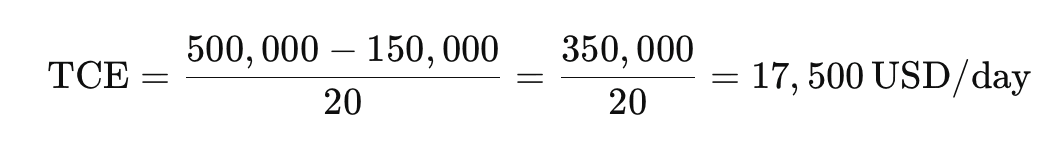

TCE Calculation Example:

Let’s say a vessel has earned $500,000 in voyage revenue, and the total voyage expenses amount to $150,000. The voyage lasted for 20 days.

In this case, the TCE is $17,500 per day.

Time Charter Equivalent (TCE) in Excel

Many operators and financial teams rely on Excel to calculate TCE due to its flexibility and widespread availability. By setting up a simple TCE calculator in Excel, you can easily track voyage revenues, expenses, and TCE over multiple voyages.

Here’s a simple way to create a time charter equivalent Excel sheet:

In your first column, list the voyages.

In the second column, input the voyage revenue.

In the third column, list the total voyage expenses.

In the fourth column, list the voyage days.

In the fifth column, use the formula

= (B2 - C2) / D2to calculate the TCE for each voyage.

This template can be expanded with more advanced features like real-time updates on fuel costs, port fees, and other key metrics.

Factors Affecting TCE Rates

While the formula for calculating TCE is straightforward, several factors influence the final result. Understanding these variables can help operators optimize their voyages and improve profitability.

Fuel (Bunker) Costs: One of the largest expenses during a voyage is fuel. Fluctuations in bunker prices directly impact the TCE. Efficient fuel management is key to maintaining a high TCE rate.

Port and Canal Fees: Different ports have different fee structures, and some canals, such as the Panama or Suez, come with hefty charges. These costs must be factored into the TCE calculation.

Voyage Duration: A longer voyage, including waiting times at ports, will reduce the TCE unless the revenue from the voyage can offset the additional time and costs.

Freight Rates: The revenue from a voyage depends on the current freight rates, which can vary based on demand, route, and cargo type. Higher freight rates improve the TCE.

Weather Conditions: Bad weather can increase voyage time and reduce efficiency, negatively impacting the TCE.

By understanding and optimizing these factors, shipping companies can improve their TCE and overall profitability.

TCE Rates and the Shipping Market

TCE rates fluctuate based on supply and demand in the shipping market. When there is a high demand for vessels (e.g., during periods of high trade volume), TCE rates increase. Conversely, when there is an oversupply of vessels, TCE rates drop.

TCE rates shipping data is often published by market analysts and provides key insights into current market conditions. Tanker TCE rates, for example, can vary significantly based on global oil demand, geopolitical events, and seasonal factors such as hurricanes affecting oil production regions.

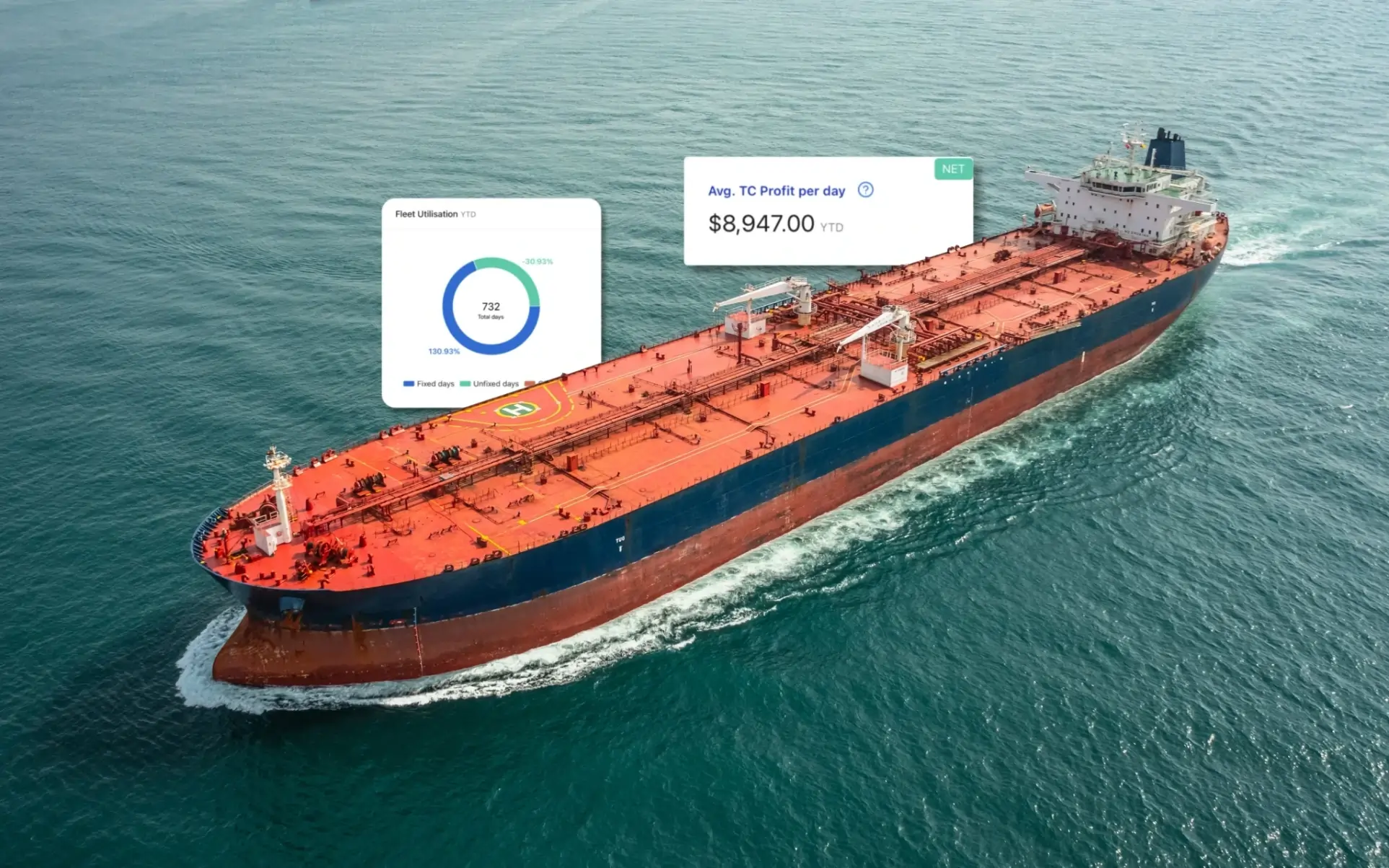

TCE for Tankers

Tanker operators, in particular, rely heavily on TCE to evaluate the profitability of their voyages. Tanker TCE ratesfluctuate based on oil demand, the number of available tankers, and external factors such as sanctions, geopolitical instability, or OPEC decisions that affect the global supply of oil.

For tanker owners and operators, using a TCE calculator is essential for making informed decisions about whether to deploy vessels on specific routes or to charter them out at current market rates.

TCE in Voyage Charters vs Time Charters

Understanding how TCE applies to different charter types is essential. In a voyage charter, where the shipowner earns revenue based on the transport of goods for a single voyage, the TCE will depend heavily on the voyage-specific costs and revenue. In contrast, a time charter generates consistent revenue over a fixed period, making the TCE calculation more stable.

In both cases, TCE serves as a useful metric to assess overall profitability, allowing shipowners and operators to compare the earnings from different chartering methods.

Want to learn the difference between a Voyage Charter and a Time Charter? Read our article here.

Do You Need a Voyage Management System (VMS) for TCE Calculations?

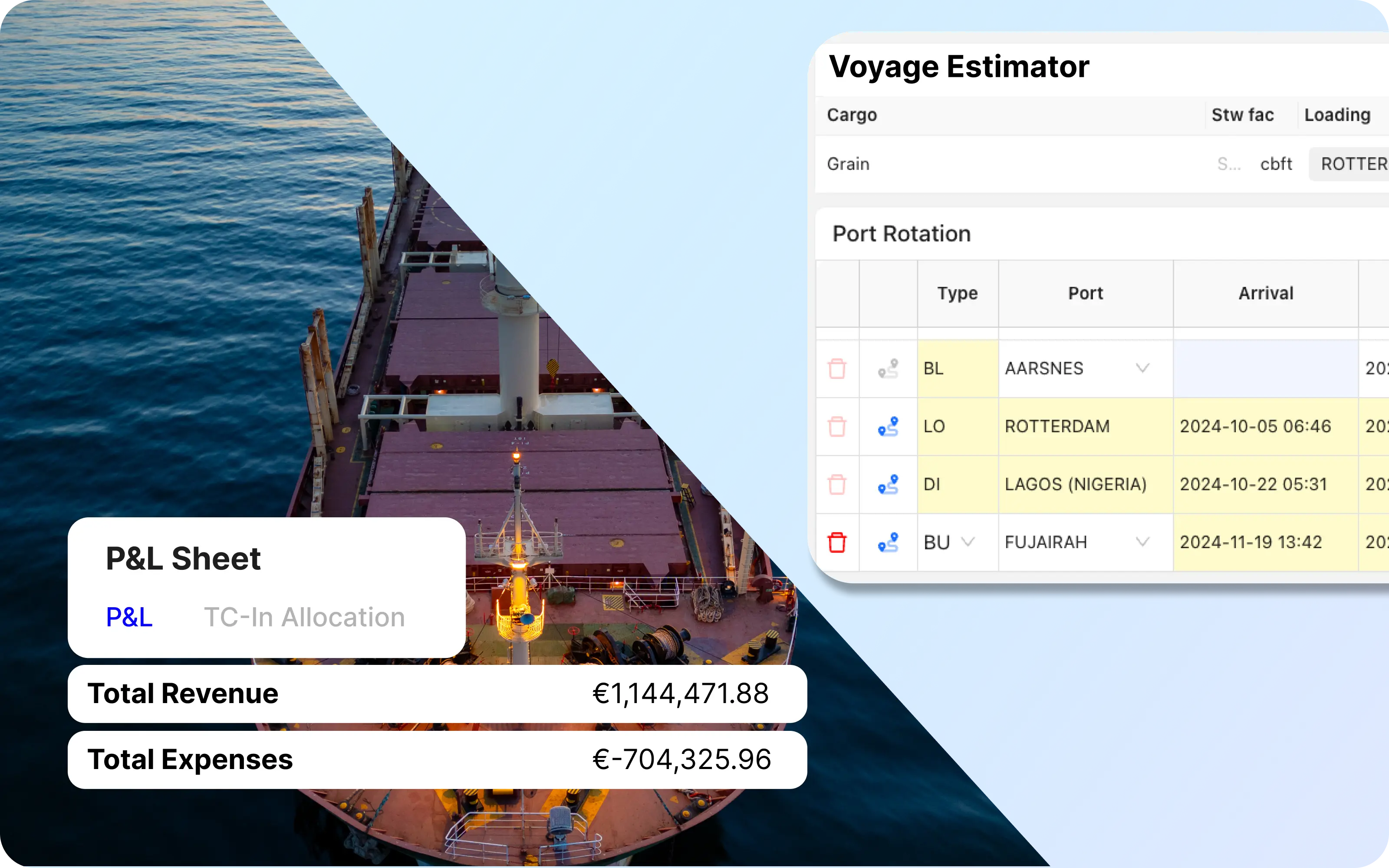

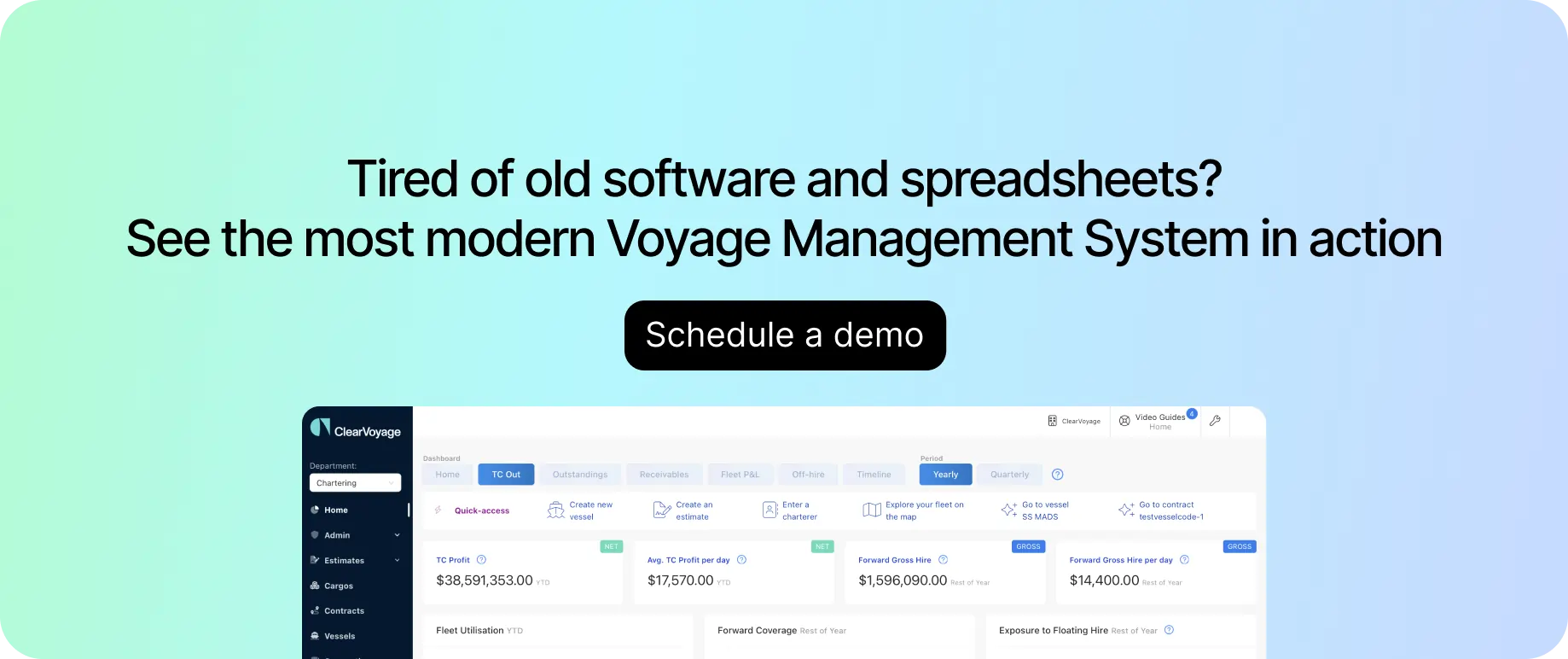

Managing TCE manually through spreadsheets or standalone calculators can be time-consuming and prone to errors, especially when dealing with multiple voyages, complex routes, and fluctuating costs. A Voyage Management System (VMS) like ClearVoyage simplifies the entire process by centralizing data, automating TCE calculations, and providing real-time insights into voyage performance.

ClearVoyage offers built-in tools to track revenue, expenses, and voyage durations, ensuring that your TCE calculations are accurate and up-to-date. With dashboards that provide a clear view of all your voyages, you can make more informed decisions about fleet deployment, charter negotiations, and operational efficiency.

The Role of TCE in P&L Management

Keeping a close eye on profitability is crucial for any shipping operation. The TCE calculation directly feeds into your Profit and Loss (P&L) statements by providing a standardized daily revenue figure for each vessel. By monitoring TCE rates, shipowners and operators can identify areas where costs are rising and take steps to mitigate them.

For instance, if the TCE for a particular voyage is lower than expected due to higher fuel costs or port delays, operators can adjust their strategies to avoid these issues in future voyages.

Why TCE Is Essential for Voyage Estimation

TCE also plays a vital role in Voyage Estimation, as it helps shipowners and operators forecast the profitability of potential routes. By using historical TCE data alongside current market rates, operators can estimate the expected daily income for a voyage, allowing them to make more informed decisions about which charters to accept or reject.

A strong voyage estimation process that includes accurate TCE calculations helps companies stay competitive by optimizing fleet deployment and avoiding unprofitable routes.

Conclusion

Time Charter Equivalent (TCE) is an essential metric for shipowners and operators who want to measure the profitability of their voyages. Whether you’re working with time charters, voyage charters, or a mix of both, TCE provides a standardized way to evaluate and compare earnings on a per-day basis.

By understanding the TCE calculation and the factors that influence it—like fuel costs, port fees, and voyage duration—you can optimize your fleet’s performance and make better operational decisions. Tools like TCE calculators and time charter equivalent Excel templates can make these calculations easier, while a robust Voyage Management System (VMS) like ClearVoyage can automate the process and ensure your financial data is accurate.

As the shipping industry continues to evolve, keeping a close eye on your TCE rates and using the right tools for calculation will be key to maintaining profitability and competitiveness.